Reviewing the market a week after Union Budget 2024 & the Indian Festive season ahead with @Officialmanishagupta Commodities Editor – @cnbcawaaz & Rajiv Popley Director – Popley Group @rajivpopley3832 @PopleyTV

https://www.instagram.com/p/C91RYIOirmB/?igsh=eDdpaXVjYmp0dnE5

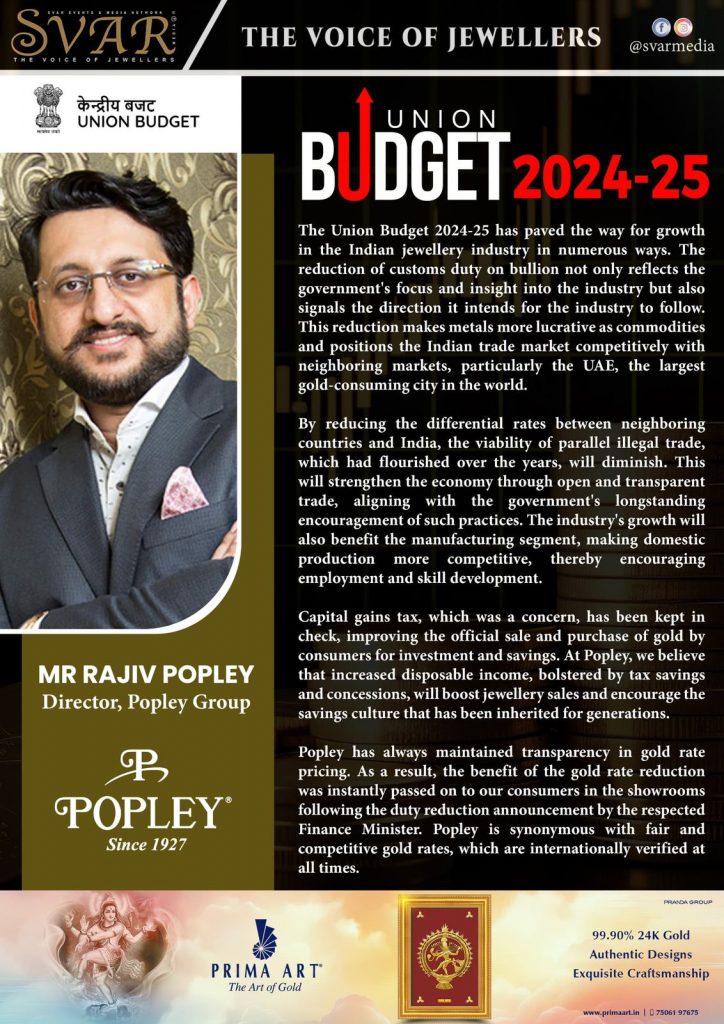

Comments on Union Budget 2024-25

The Union Budget 2024-25 has paved the way for growth in the Indian jewellery industry in numerous ways. The reduction of customs duty on bullion not only reflects the government’s focus and insight into the industry but also signals the direction it intends for the industry to follow. This reduction makes metals more lucrative as commodities and positions the Indian trade market competitively with neighboring markets, particularly the UAE, the largest gold-consuming city in the world.

By reducing the differential rates between neighboring countries and India, the viability of parallel illegal trade, which had flourished over the years, will diminish. This will strengthen the economy through open and transparent trade, aligning with the government’s longstanding encouragement of such practices. The industry’s growth will also benefit the manufacturing segment, making domestic production more competitive, thereby encouraging employment and skill development.

Capital gains tax, which was a concern, has been kept in check, improving the official sale and purchase of gold by consumers for investment and savings. At Popley, we believe that increased disposable income, bolstered by tax savings and concessions, will boost jewellery sales and encourage the savings culture that has been inherited for generations.

Popley has always maintained transparency in gold rate pricing. As a result, the benefit of the gold rate reduction was instantly passed on to our consumers in the showrooms following the duty reduction announcement by the respected Finance Minister. Popley is synonymous with fair and competitive gold rates, which are internationally verified at all times.

To check the 22k Gold Rate, click here: https://wa.link/xtxiq7

Reviewing the Union Budget 2024-25 for the Gold Industry on CNBC Awaaz

Join Manisha Gupta, Chief Editor – Commodities, as she discusses the impact of the Union Budget 2024-25 on the gold industry with Rajiv Popley, Director – Popley Group.

Explore insights on:

- The reduction of customs duty on bullion.

- How the government’s strategic decisions will influence the Indian jewellery industry.

- Comparative advantages for India against neighboring markets, such as the UAE.

- Measures to curb parallel illegal trade and strengthen the economy.

- Implications for domestic production, employment, and skill development.

- Effects of capital gains tax policies on official gold sales and consumer investments.

Tune in to CNBC Awaaz with the above link for an in-depth analysis of these transformative changes and understand how Popley is adapting to ensure transparency and competitive pricing in gold rates.

CNBC Awaaz Commodities with Manisha Gupta on Gold outlook & demand for Akshay Trithi festival

Gold Update on Cnbc Awaaz with Manisha Gupta & Rajiv Popley 25-4-24

GOLDEN LOVE : Valentines Day Special CNBC Awaaz

Gold Spot CNBC Awaaz Deepali Rana 14-2-24 11:30am

Gold Rally Reason: Gold gave a return of 7% in October, what is the reason behind this rise of 7 months?

CNBC Awaaz on Dhanteras with Manisha Gupta & Rajiv Popley

CNBC Awaaz Pre Diwali expectations & trends with Manisha Gupta, Deepali Rana & Rajiv Popley November 2023

Commodity Market Updates: Festivals में कैसा रहेगा Gold-Silver का हाल | Gold Price | Silver Price 28-7-23

Commodity Market | US की June CPI गिरकर 3% पर, Gold पर कितना पड़ा असर? | Gold Price Today 14-7-2023

Gold Industry In India with Manisha Gupta on CNBC Awaaz 24-6-2023

CNBC Awaaz on Akshay Trithi 2023 Gold Sales Gold Industry In India with Manisha Gupta on CNBC Awaaz

CNBC Awaaz with Valentines Day shopping views

Gold Spot News for 2023 with CNBC Awaaz

Expectations from the Union Budget 2022

CNBC Awaaz – Manisha Gupta Editor Commodities talks to Rajiv Popley